The Foley Report

Real Estate Resource, everything Willow Glen and Surrounding Communities,community interest articles, lifestyle, local events, gardening and garden trends, and quality of living in the charming neighborhoods of San Jose. Cambrian, Campbell, Santa Clara, Naglee Park, Rosegarden, Downtown.

Search This Blog

Tuesday, January 20, 2026

Friday, January 17, 2025

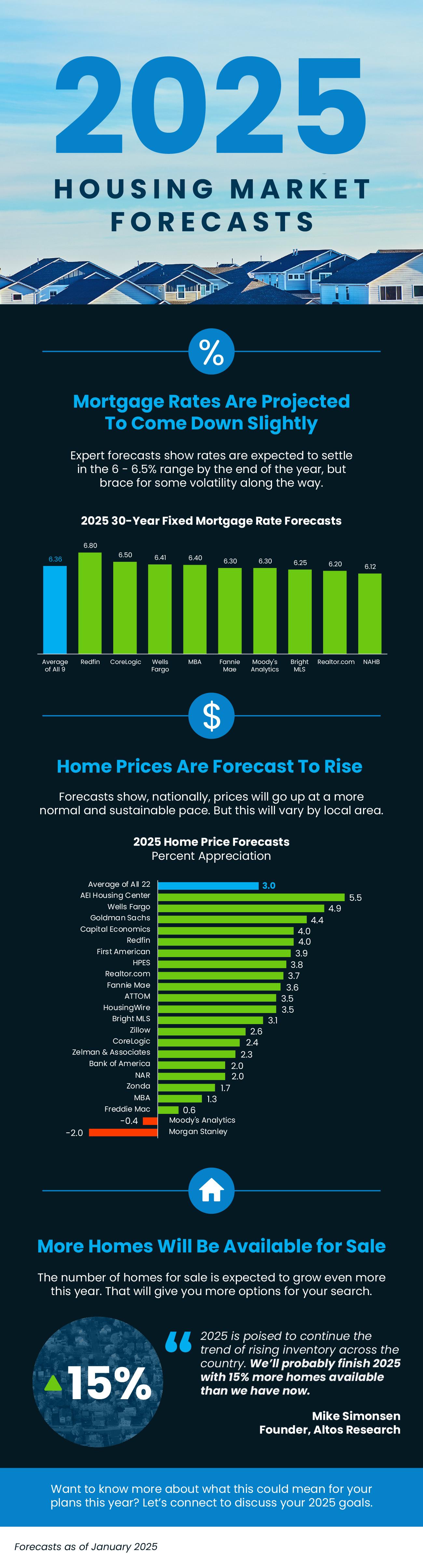

2025 Housing Market Forecasts

2025 Housing Market Forecasts

Some Highlights

- Wondering what to expect when you buy or sell a home this year? Here’s what the experts say lies ahead.

- Mortgage rates are projected to come down slightly. Home prices are forecast to rise in most areas. And, there will be more homes available for sale.

- Want to know more about what this could mean for your plans this year? Let’s connect to discuss your 2025 goals.

Saturday, October 26, 2024

Monday, May 6, 2024

Why Move?

What's Motivating Your Move?

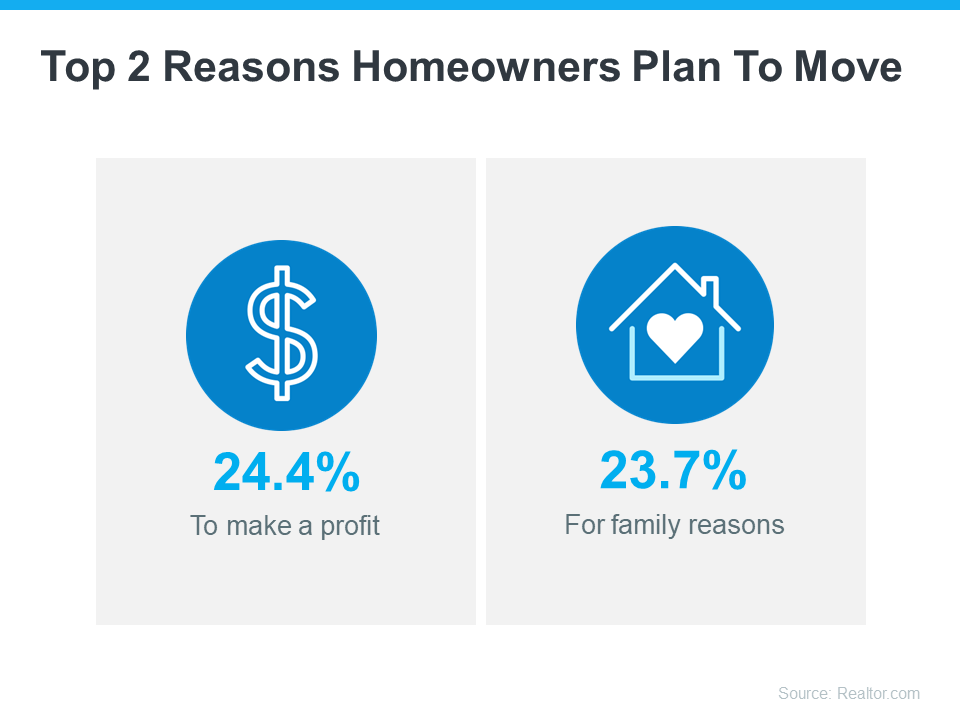

Thinking about selling your house? As you make your decision, consider what's pushing you to think about moving. A recent survey from Realtor.com looked into why people want to sell their homes this year. Here are the top two reasons (see graphic below):

Let's take a closer look and see if they’re motivating you to make a change too.

1. To Make a Profit

If you’re thinking about selling your house, you probably have a lot of questions on your mind. Well, here's some good news – the latest data shows most sellers get a great return on their investment when they sell. ATTOM, a property data provider, explains:

“. . . home sellers made a $121,000 profit on the typical sale in 2023, generating a 56.5 percent return on investment.”

That’s significant. And here’s one contributing factor. During the pandemic, home prices skyrocketed. There was way more buyer demand than homes available for sale and that combination pushed prices up.

Now, home prices are still rising, just not as fast. That ongoing appreciation is good news for your bottom line. Any profit you make can help offset some of today’s affordability challenges when you buy your next home.

If you want to know how much your house is worth now and what's going on with prices in your area, talk to a local real estate agent.

2. For Family Reasons

Maybe you want to be near relatives to help take care of older family members or to have more support nearby. Or maybe you’re just eager to spend time together on special occasions like birthdays and holidays.

Selling a house and moving closer to the people who matter the most to you helps keep you connected. If the distance is making you miss out on some big milestones in their lives, it might be time to talk to a local real estate agent to find a place close by. The National Association of Realtors (NAR) says:

“A great real estate agent will guide you through the home search with an unbiased eye, helping you meet your buying objectives while staying within your budget.”

Bottom Line

If you're thinking about selling your house, there’s probably a good reason for it. Let’s talk so you have help making the right move to reach your goals this year.

Tuesday, June 13, 2023

What Has Changed in Your Life?

Your Needs Matter More Than Today’s Mortgage Rates

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not lose sight of the reason you want to make a change in the first place.

It’s true mortgage rates have climbed from the record lows we saw in recent years, and that has an impact on affordability. With rates where they are right now, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home. As Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . homeowners who locked in a 30-year fixed rate in the 2-3% range don't necessarily want to give that up in exchange for a rate in the 6-7% range.”

But your lifestyle and your changing needs should matter more. Here are a few of the most common reasons people choose to sell today. Any one of these may be more important than keeping your current mortgage rate.

As Ali Wolf, Chief Economist at Zonda, says in a recent tweet:

“First-time and move-up buyers are both active . . . the latter driven by life changes. Divorce, marriage, new higher paid job, and existing home unsuitable all referenced.”

Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in a dream location, or just looking for a change in scenery.

For example, if you live in suburbia and just landed your dream job in NYC, you may be thinking about selling your current home and moving to the city for work.

Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and decide it’s time to seek out a home with more space, or if your household is growing, it may be time to find a home that better fits those needs.

Downsizing

With inflation driving up everyday expenses, homeowners may also decide to sell to reduce maintenance and costs. Or, they may sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move to somewhere you can enjoy the warm weather and have less house to maintain. Your new lifestyle may be better suited for a different home.

Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell to buy different homes.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and downsizing may be better options.

Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their current home to find one that works better for them.

For example, you may be looking to sell your home and use the proceeds to help pay for a unit in an assisted-living facility.

With higher mortgage rates, there are some affordability challenges right now – but your needs and your lifestyle matter too. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal decision. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you’re ready to sell your house so you can make a move, let’s connect so you have an expert on your side to help you navigate the process and find a home that can deliver on what you’re looking for.